Misselling in financial services is more common than many realise. Research indicates that a significant percentage of consumers have experienced some form of misselling, with nearly 20% of customers reporting being offered products that were financially unsuitable for their needs and economic situations. This problem isn’t just about poor sales tactics—financial misselling undermines consumer trust and highlights the urgent need for greater transparency and integrity across the industry.

Misselling in insurance poses a serious challenge in an industry fundamentally built on trust. The repercussions are far-reaching—ranging from customer dissatisfaction and policy lapses to regulatory penalties and a tarnished brand reputation. Thankfully, with the emergence of AI in insurance, there are now powerful tools available to help prevent these unethical sales practices, ensuring that customers receive policies that truly align with their needs.

In this blog, we’ll explore what misselling in insurance means, the risks it involves, and how leveraging AI can be a game-changer for controlling and ultimately preventing these practices, helping insurers foster genuine trust and long-term customer relationships.

What is MIS-Selling in Insurance?

Misselling meaning refers to the unethical practice of selling a product that is not suitable for a customer’s needs, often due to incomplete or misleading information. This practice is typically driven by agents aiming to earn higher commissions or meet sales targets, rather than focusing on the best interest of the customer.

Now, you may ask, what are the practices of misselling and how can we identify misselling beforehand?

Common examples of misselling can take several forms, such as:

Omitting Crucial Details:

Important information like policy exclusions, waiting periods, or hidden charges is not disclosed, leaving customers unaware of the actual limitations of their coverage. This contributes to misselling in insurance by creating unrealistic expectations.

Exaggerating Benefits:

Agents may overpromise the advantages of an insurance policy, such as unrealistic returns or guaranteed payouts, without mentioning associated risks or conditions. Such tactics often lead to misselling, as customers end up purchasing products based on false promises.

Inappropriate Recommendations:

Recommending a product that doesn’t align with a customer’s needs—such as offering a long-term investment policy when they need short-term coverage—leads to a mismatch in expectations. This highlights the risks of misselling, as customers may find themselves with unsuitable products that do not meet their financial goals.

High-Pressure Sales:

Customers are often rushed into purchasing without being given adequate time to understand their options. This is a key example of mis-selling practices, which prioritizes sales over the customer’s informed decision-making.

Such practices undermine consumer trust and create long-term reputational damage for insurers. Addressing misselling in insurance is crucial to maintaining transparency, integrity, and trust in the insurance industry. Employing effective strategies to prevent misselling and leveraging AI in insurance can help control these unethical practices and build stronger customer relationships.

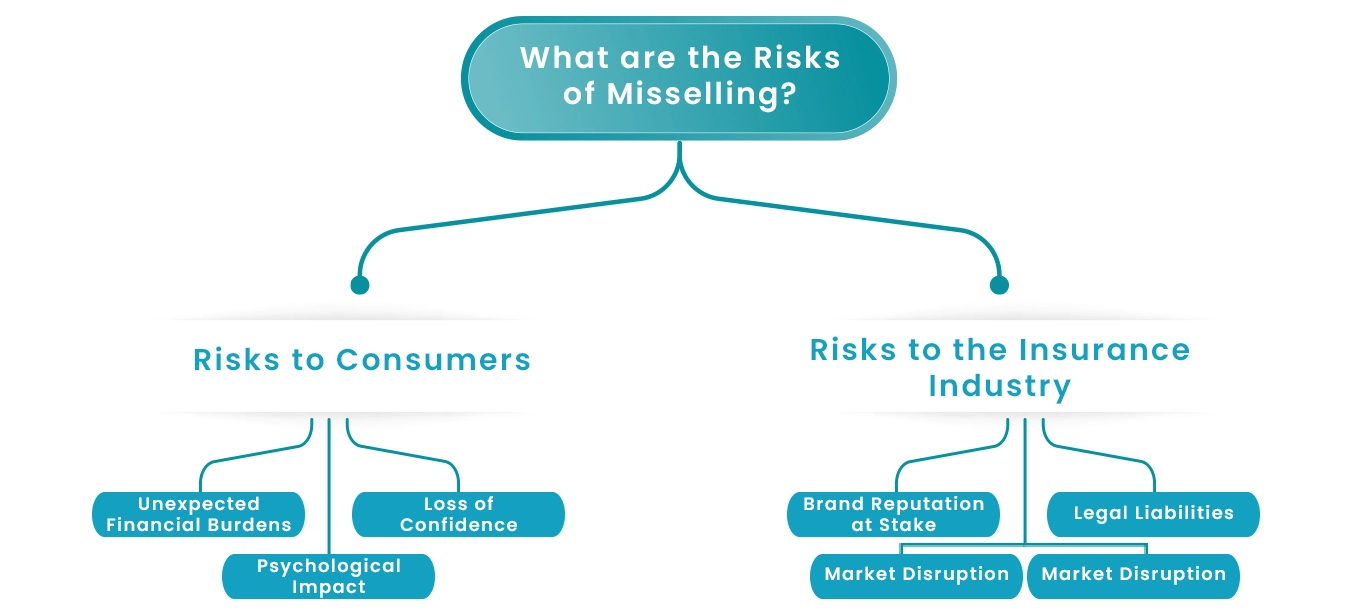

What are the Risks of Misselling?

Misselling in the insurance industry presents substantial risks that can have lasting effects on both consumers and providers. Recognizing these risks is vital for fostering a culture of transparency and trust.

Risks to Consumers:

- Unexpected Financial Burdens: Consumers may end up with insurance policies that do not meet their actual needs, leading to unanticipated financial strain. Many of these policies fall short of delivering the promised benefits, leaving consumers vulnerable to financial loss.

- Loss of Confidence: When customers feel misled by insurance providers, their trust erodes. This disillusionment can lead to hesitation in future financial engagements, as consumers may fear being deceived again.

- Psychological Impact: The distress from realizing one has been misled can be profound. Individuals often experience significant anxiety and frustration, particularly when facing challenges in claiming benefits or discovering limitations in their coverage at critical times.

Risks to the Insurance Industry:

-

- Brand Reputation at Stake: The practices of misselling can severely damage an insurer’s reputation. A single incident can deter potential clients and lead to a loss of loyalty among existing customers, impacting overall business performance.

- Increased Regulatory Pressure: The rise in misselling complaints often leads to tighter regulations and oversight from authorities. Insurance companies may find themselves facing higher compliance costs and more stringent operational demands.

- Legal Liabilities: Engaging in misselling can result in costly legal battles and penalties. The financial burden from litigation and fines can strain resources, diverting focus away from essential business functions.

- Market Disruption: A widespread culture of misselling can lead to a decrease in consumer participation in the insurance market. As confidence wanes, potential customers may choose to forgo purchasing insurance altogether, ultimately hindering industry growth and stability.

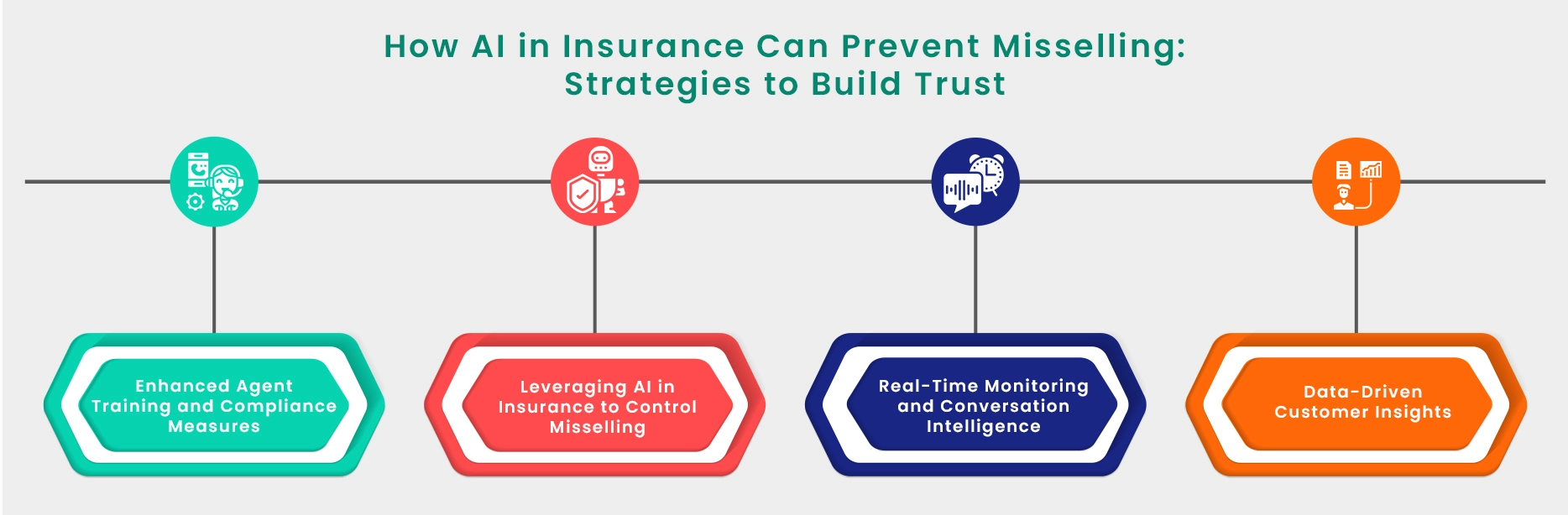

How AI in Insurance Can Prevent Misselling: Strategies to Build Trust

Preventing misselling in insurance requires a combination of powerful strategies, advanced technology, and proactive management practices. The question “How do I control misselling in insurance?” is on the minds of many industry leaders, and the answer lies in leveraging modern solutions like AI while also enhancing regulatory compliance and agent training.

Enhanced Agent Training and Compliance Measures:

The first step to preventing misselling is to ensure that insurance agents receive comprehensive training focused on ethical selling practices. Training programs should emphasize understanding customer needs, providing full disclosure of terms, and aligning products with customer requirements. Strict compliance checks and adherence to regulatory guidelines also play a vital role in reducing the occurrence of misselling.

Leveraging AI in Insurance to Control Misselling:

One of the most powerful solutions today is the adoption of artificial intelligence. How AI in insurance helps control misselling is through its ability to analyze vast amounts of data, monitor agent interactions, and identify potential unethical practices in real time. AI-powered conversation intelligence software like Mihup Agent Assist in the insurance industry can assess the quality of customer-agent interactions, detect misleading claims, and flag conversations where crucial product details are omitted.

Real-Time Monitoring and Conversation Intelligence:

Using AI in insurance offers real-time monitoring capabilities that can help supervisors intervene before a sale turns into a case of misselling. Tools such as Mihup Agent Assist allow insurers to track sales calls, evaluate customer responses, and ensure that agents are providing accurate, transparent information. This proactive monitoring approach directly addresses how to control misselling in insurance, reducing the risk of miscommunication or misinformation.

Data-Driven Customer Insights:

AI-driven analytics provide insights into customer behavior, preferences, and needs. By using this data, agents can make more informed recommendations, aligning products with the specific financial goals and risk profiles of each customer. This ensures that policies are suitable, thus minimizing the risk of inappropriate recommendations—a key aspect of misselling.

Transparent Communication and Consumer Education: Empowering customers with clear, accessible information about insurance products is another crucial strategy. AI chatbots and virtual assistants can be used to answer customer queries instantly, help them understand complex terms, and guide them through policy features. Transparency in communication, combined with effective consumer education, strengthens trust and reduces the likelihood of misselling.

Conclusion: AI as a Shield Against Misselling

Misselling in the insurance industry is a major concern that threatens the very foundation of trust between customers and insurers. With AI in insurance, we are now in a position to control and eventually eliminate misselling through proactive measures.

Conversation intelligence software in the insurance industry is just one of the many tools that AI brings to the table. By embracing AI, insurance companies can foster transparent, informed, and customer-first sales practices that benefit everyone involved. Trust Mihup.ai, India’s leading Conversation Intelligence Platform, for more transparent and trustworthy insurance practices. Schedule a demo call with Mihup to start transforming your sales practices!