Future Trends of Generative AI In Banking

Generative AI has brought a new wave in the banking industry as financial institutions are using this technology to help them chat with customers more easily through chatbots, catch fraud before it happens, and save time on boring tasks like writing computer code, making sales presentations, and summarizing bank rules. It was mentioned in Mckinsey’s 2023 banking report that productivity in the banking sector would be enhanced by up to 5 % and up to $300 billion expenditure would be reduced. But this is just the beginning.

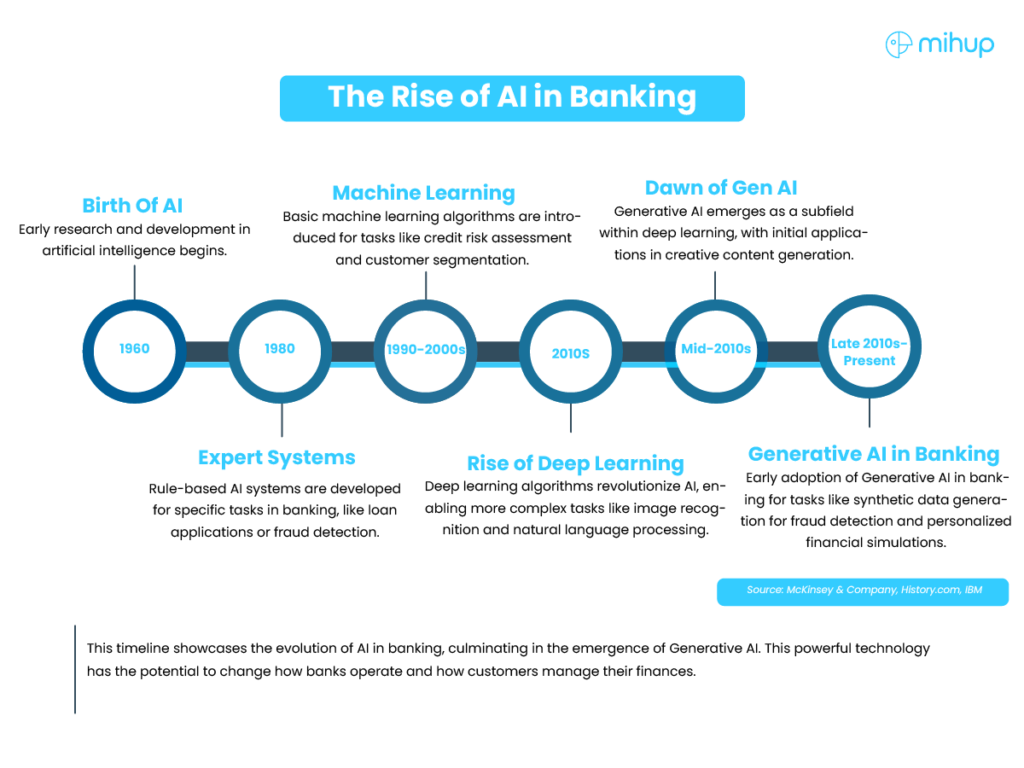

Artificial intelligence (AI) in finance is transforming the financial landscape, and Generative AI in Banking stands poised to redefine how we manage our money. Imagine a world where your bank account anticipates your needs, suggests personalized investment strategies, and even detects fraudulent activity before it happens. This isn’t science fiction; it’s the future fueled by AI in banking and finance.

What is the reason for the adoption of AI in Banking:

Top financial executives are practically tripping over each other in their race to adopt intelligent tools. Why? Because they know these tools hold the key to future success. According to NTT Data, “more than 80% of financial institutions believe AI is the key competitive driver to success.” Industry leaders are convinced that AI is the secret weapon for differentiating themselves and attracting new customers, thanks to its ability to unlock the power of unique data sets. However, despite the enthusiasm, some hurdles remain, and adoption hasn’t quite caught up to the hype.

Understanding Generative AI:

Generative AI takes things a step further. It doesn’t just analyze existing data; it can create entirely new data sets, like text, code, or even realistic simulations. This opens doors for transformative applications in the realm of finance.

How Generative AI Will Reshape Banking

AI in banking is no longer a futuristic concept. Banks already employ AI in financial services to automate tasks, improve risk assessments, and personalize customer experiences. Generative AI in Banking takes this a step further by enabling:

- Personalized Investment Strategies: Generative AI can create custom financial simulations that factor in your income, savings goals, risk tolerance, and even potential market fluctuations based on historical data and current trends. This allows for a more dynamic and tailored approach to wealth management, compared to traditional one-size-fits-all investment strategies. By personalizing your investment strategy, generative AI can help you maximize potential returns while minimizing risk.

- Proactive Fraud Detection: Traditional fraud detection relies on identifying patterns in past attacks. Generative AI can go beyond the reactive by creating synthetic data that mimic potential fraudulent activities. This allows AI models to learn and identify new fraud patterns before they occur, safeguarding your hard-earned money.

- Next-Level Risk Assessment: Artificial intelligence for finance professionals is already used to assess loan applications and creditworthiness. But Generative AI can create entirely new scenarios, simulating potential economic downturns or unforeseen events. This allows banks to make more informed decisions about lending and risk management.

- The Rise of the AI Robo-Advisor: Imagine a financial advisor available 24/7, constantly monitoring market trends and offering real-time financial advice. This is the future of AI in banking and finance. Generative AI can power sophisticated robo-advisors that learn your financial habits and goals, suggesting personalized investment strategies and navigating economic uncertainties.

Challenges and Considerations

While the future of Generative AI in Banking appears bright, there are challenges to consider:

- Biasness and Fairness: AI models work on the data they’re trained on. If training data is biased, AI systems can perpetuate those biases in their decision-making. Ensuring fairness and inclusivity in Generative AI models is paramount.

- Explainability and Transparency: AI in financial services can be a black box. Understanding how AI models reach decisions is crucial for building trust with customers and regulators. Generative AI development needs to prioritize transparency and explainability.

- Security Concerns: Generative AI can create realistic simulations, raising concerns about its potential misuse in creating deepfakes or synthetic data for fraudulent purposes. Robust security measures are vital to mitigate these risks.

The Future of AI in Banking: A Collaborative Journey

Generative AI in Banking is not just about automating tasks; it’s about unlocking a future where financial institutions can leverage imagination to empower their customers. The future of AI in banking requires collaboration between financial institutions, AI developers, and regulatory bodies. By addressing the challenges and harnessing the immense potential of Generative AI, we can create a more secure, efficient, and personalized banking experience for everyone. AI finance is no longer a futuristic concept as it’s a future where your bank doesn’t just manage your money; it helps you manage your financial future, one intelligent step at a time.